Due date for Bonus payment is approaching for the period of 2014-15, We wish to update you with some Important Information on Bonus.

Information Note:

Definition of Maximum Bonus and Minimum Bonus:

Section 10. Payment of minimum bonus:

Subject to the other provisions of this Act, every employer shall be bound to pay to every employee in respect of the accounting year commencing on any day in the year 1979 and in respect of every subsequent accounting year, a minimum bonus which shall be 8.33 percent. Of the salary or wage earned by the employee during the accounting year or one hundered rupees, whichever is higher, whether or not the employer has any allocable surplus in the accounting year:

Provided that where an employee has not completed fifteen years of age at the beginning of the accounting year, the provisions of this section shall have effect in relation to such employee as if for the words “one hundred rupees”, the words “sixty rupees” were substituted.

Section 11. Payment of maximum bonus –

(1) Where in respect of any accounting year referred to in section 10, the allocable surplus exceeds the amount of minimum bonus payable to the employees under that section, the employer shall, in lieu of such minimum bonus, be bound to pay to every employee in respect of that accounting year bonus which shall be an amount in proportion to the salary or wage earned by the employee during the accounting year subject to a maximum of twenty per cent. Of such salary or wage.

(2) In computing the allocable surplus under this section, the amount set on or the amount set off under the provisions of section 15 shall be taken into account in accordance with the provisions of that section]

Detailed note on Statutory Bonus is given below for your reference:

According to this gazette notification, (which is appended at the end of this mail) every employee who was earning Basic (+DA) is EQUAL or LESS than 10,000/- p.m., will come under the purview of the act, and the same employee would be entitled to Bonus to the maximum of Rs. 3,500/= (if the % of bonus declared @ 8.33%). As per the provisions of the act, the employer must pay bonus within EIGHT months of completion of the Financial Year. This leaves the company with just one month to calculate and pay bonus under the Act. You are left with no option but to pay the same with immediate effect. (Generally companies / Govt. declare bonus just before Diwali).

Please note that every company enjoys bonus holiday for the first five years, provided the company does not make any profits. In case if any of those companies which makes profit of more than one months’ Total Basic & DA, then they would be obliged to pay Bonus for that year. However the company would be exempted from the payment of Bonus in case if they ensure that the profit earned are properly accounted / adjusted towards the expenses of expansion, etc.

The Q&A under the Payment of Bonus Act to give you a better understanding:

To which factories or establishments does the Payment of Bonus Act 1965 apply?

The Payment of Bonus Act, 1965 applies to every factory and several other establishments in which 20 or more persons are employed on any day during the accounting year (S.1).

Who is considered to be an Employer under the Payment of Bonus Act?

'Employer' includes the following:

- in relation to an establishment which is a factory, the owner or occupier of the factory, including the agent of such owner or occupier; the legal representative of a deceased owner or occupier; and where a person has been named as a manager of the factory under clause (f) of sub-section (1) of Section 7 of the Factories Act, 1948 (63 of 1948), the person so named;

- in relation to any other establishment, the person, who, or the authority which, has the ultimate control over the affairs of the establishment and where the said affairs are entrusted to a manager, managing director or managing agent, such manager, managing director or managing agent.

Who is considered to be an employee under the Payment of Bonus Act?

This definition is specific to the Payment of Bonus Act, 1965. [Refer to the definition of the word 'workman' in other Acts for the purposes of those Acts].

An 'employee' means any person (other than an apprentice), employed on salary or wage not exceeding Rs.10,000/- per month in any industry to do any skilled or unskilled, manual, supervisory, managerial, administrative, technical or clerical work for hire or reward, whether the terms of employment are expressed or implied. [S.2 (13)].

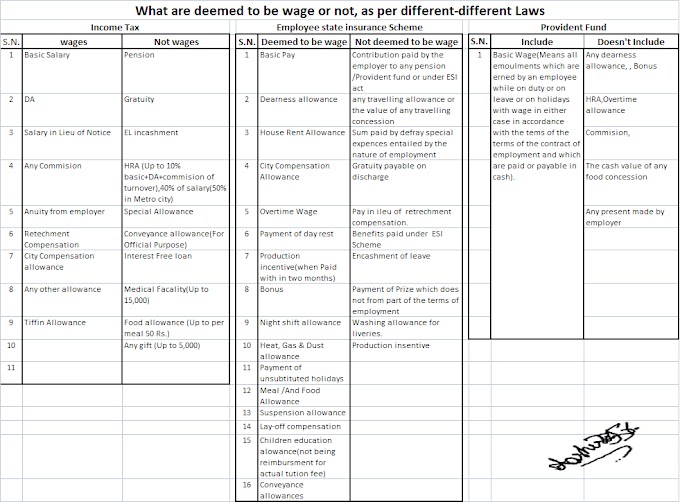

Define 'salary' or 'wage' under the Payment of Bonus Act, 1965.

[This definition is specific to the Payment of Bonus Act, 1965. Refer to definition of the word 'salary' or 'wage' in other Acts for the purposes of those Acts].

'Salary' or 'wage' means all remuneration (other than remuneration in respect of over-time work) that may be expressed in terms of money and includes dearness allowance but does not include the following:

- any other allowance which the employee is, for the time being, entitled to;

- the value of any accommodation or supply of light, water, medical attendance or any other amenity or of any service or any concessional supply of food grains or other articles;

- any travelling concession;

- any bonus (including incentives, production and attendance bonus);

- any contribution paid or payable by the employers to any pension fund or provident fund;

- any retrenchment compensation or any gratuity or other retirement benefits, payable to the employee or any ex-gratia payment made to him;

- any commission payable to the employee.

Who is eligible for bonus under the Payment of Bonus Act?

Every employee is entitled to bonus in an accounting year, in accordance with the provisions of this Act, provided he has worked in the establishment for not less than thirty working days.

What is the minimum and maximum bonus, which the employer is bound to pay to the employees?

In every establishment to which the Payment of Bonus Act, 1965 applies, the employer shall be bound to pay to every employee in respect of accounting year, the minimum bonus which shall be 8.33% of the salary or wage, earned by the employee during the accounting year or Rs.100/- whichever is higher, whether or not, the employer has any allocable surplus in the accounting year (S.10). The maximum bonus payable is 20% of the salary or wage of the employee where the salary or wage of the employee does not exceed Rs.3,500/- p.m. (S.11). Where the salary or wage of the employee exceeds Rs.3,500/- p.m., the bonus payable to such employee shall be calculated as if his salary or wage were Rs.3,500/- p.m. (S.12).

What is meant by proportionate reduction in Bonus under Payment of Bonus Act?

Where an employee has not worked for all the working days in an accounting year, the minimum bonus of one hundred rupees or, as the case may be, of sixty rupees, if such bonus is higher than 8.33% of his salary or wage for the days he has worked in that accounting year, shall be proportionately reduced.

What is meant by allocable Surplus under the Payment of Bonus Act?

If a Company is other than a banking Company, Allocable Surplus means 67% of the available surplus.

Is the employer obliged to pay the minimum bonus even if the allocable surplus is not sufficient? What is the case when the allocable surplus is in excess?

Where the allocable surplus is not sufficient to pay the minimum bonus of 8.33% or Rs.100/- whichever is higher, the employer is obliged to pay the minimum bonus. However, he is entitled to carry it forward so that it may be set off against the allocable surplus in the succeeding year and so on, up to and inclusive of the 4th accounting year thereafter. Likewise, if there is allocable surplus after payment of the maximum bonus of 20%, the excess amount is to be carried forward for being set off in the succeeding accounting year and so on up to and inclusive of the 4th accounting year. Thereafter, it may be utilized for the purpose of payment of bonus (S.15). The employer is entitled to adjust customary or interim bonus, if any, against bonus payable under this Act [S.17 of Payment of Bonus Act, 1965].

Is it lawful for the employee to deduct any amount from the bonus, payable by him to the employee?

Where in an accounting year, the employee is found guilty of misconduct, causing financial loss to the employer, then it is lawful for the employer to deduct the amount of loss from the bonus payable by him to the employee in respect of that accounting year only. The employee is entitled to receive balance if any [S.18 of Payment of Bonus Act, 1965].

When is an employee disqualified from receiving bonus?

An employee is disqualified from receiving any bonus if he is dismissed from service for the following:

- fraud;

- violent behavior while on the premises of the establishment;

- theft, misappropriation or sabotage of any property of the establishment.

(S.9 of Payment of Bonus Act, 1965).

When is an employee not deemed eligible for bonus or only entitled to a reduced minimum bonus?

An employee, who has less than one month's service in the accounting year, is not eligible for the bonus for that accounting year and, an employee, who has not worked for all the working days in an accounting year, the bonus shall be proportionately reduced.

(S.13 of Payment of Bonus Act, 1965).

However, an employee shall be deemed to have worked in an establishment in any accounting year also on the days on which:

- he has been laid off under an agreement or as permitted by standing orders under the Industrial Employment (Standing Orders) Act, 1946, or under the Industrial Disputes Act, 1947, or under any other law, applicable to the establishment;

- he has been on leave with salary or wage;

- he has been disabled due to temporary disablement, caused by an accident arising out of and in course of his employment;

- the employee has been on maternity leave with salary or wage, during the accounting year.

(S.14 of Payment of bonus Act, 1965).

What is the process for computation of the number of working days for the Payment of bonus Act?

For the purposes of Section 13, an employee shall be deemed to have worked in an establishment in any accounting year also on the days on which:

- he has been laid off under an agreement or, as permitted by the standing orders under the Industrial Employment (Standing Order) Act, 1946 (20 of 1946), or under the Industrial Disputes Act, 1947, (14 of 1947), or under any other law applicable to the establishment;

- he has been on leave with salary or wage;

- he has been absent due to temporary disablement caused by accident arising out of and in the course of his employment;

- the employee has been on maternity leave with salary or wage during the accounting year.

When should the amount, payable to the employee by way of bonus, be paid by the employer?

All amounts, payable to the employee by way of bonus, shall be paid in cash by the employer in the following situations:

- where there is a dispute regarding payment of bonus pending before any authority under S.22, within a month from the date of which the award becomes enforceable or the settlement comes into operation, in respect of such disputes;

- in any other case, within a period of 8 months from the close of the accounting year.

How can the amount of money, due from an employer by way of bonus be recovered?

The amount of money due from an employer by way of bonus can be recovered by making an application to an appropriate Government within 1 year from the date of which money becomes due to the employee from the employer. However, such application may be entertained even after a period of 1 year if the appropriate Government is satisfied that there is sufficient cause for not making application within that time.

[S. 21 of Payment of Bonus Act, 1965].

What are the provisions for dealing with disputes under this Act?

According to Section 22 where any dispute arises between an employer and his employees with respect to the following:

- Bonus payable under this Act;

- Application of this Act to an establishment in public sector;

Then such dispute shall be deemed to be an Industrial Dispute within the meaning of Industrial Dispute Act or any other corresponding law.

What are the powers of the Inspectors under this Act?

An Inspector, appointed under this Act in order to make sure that the provisions of this Act have been complied with, is empowered to do the following:

- To ask for such information as he may consider necessary from the employer;

- At any reasonable time with the assistance of somebody, if anyone enters any establishment or any premises connected therewith and require anyone, found in charge thereof, to produce before him for examination, any accounts, books, registers and other documents, relating to the employment of the person or the payment of salary or wage or bonus in the establishment;

- To make copies or take extracts from any books register or other documents, maintained in relation to the establishment;

- To exercise such other powers as may be prescribed.

The Payment of Bonus (Amendment) Ordinance, 2007 (27-Oct-07)

[No. 8 OF 2007]

Promulgated by the President in the Fifty-eighth Year of the Republic of India

PREAMBLE

An Ordinance further to amend the Payment of Bonus Act, 1954.

Whereas Parliament is not in session and the President is satisfied that circumstances exist which render it necessary for her to take immediate action;

Now, THEREFORE, in exercise of the power conferred by clause (1) of article 123 of the Constitution, the President is pleased to promulgate the following ordinance:-

1. Short title and commencement.--

(1) This Ordinance may be called the Payment of Bonus (Amendment) Ordinance, 2007.

(2) It shall be deemed to have come into force, on the 1st day of April, 2006.

2. Amendment of section 2.--

In Section 2 of the Payment of Bonus Act, 1965(21 of 1965), (hereinafter referred to as the Principal Act), in clause (13), for the words "three thousand and five hundred rupees", the words "ten thousand rupees" shall be substituted.

3. Amendment of Section 12.--

In section 12 of the Principal Act, for the words "two thousand and five hundred rupees", in both the places where they occur, the words "three thousand and five hundred rupees" shall be substituted.

4. Amendment of Section 32.--

In section 32 of the Principal Act, clause (vi) shall be omitted.

0 Comments