About Latest Amendment

The most significant

latest change in the act are wage eligibility limit increased from INR 10,000

to INR 21,000 and the calculation ceiling from INR 3,500 to INR 7,000 or the

minimum wage notified by the appropriate Government for that category of

employment, whichever is higher was incorporated . Taking into due

consideration the demands provided by the trade unions in relation to

amendments to be carried out to the Payment of Bonus Act, 1965 (Principal Act),

the Payment of Bonus (Amendment) Bill, 2015 (Amendment Bill), was passed on 22

December 2015. And then the Amendment Bill passed by the Rajya Sabha on 23 December

2015 and being called the Payment of Bonus (Amendment) Act, 2015 (Amendment

Act), received the assent of the President of India on 31 December 2015.

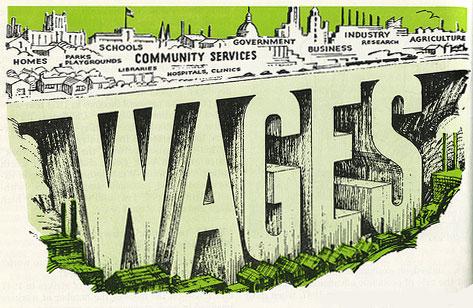

History

The Principal Act provides mandatory annual payment

of bonus to all the eligible employees of establishments with 20 or more

persons. Employees who draws a salary of INR 10,000 or below per month and

worked for not less than 30 days in a Financial year is eligible for bonus.

Overview of Amendment

Amendment of

Eligibility Limit

Amendment in Section 2(13) of the Principal Act,

the Amendment Act has now increased the scope of employees eligible for payment

of bonus from those drawing salary of INR 10,000 per month, to INR 21,000 per

month.

The act covers the employee who earns between INR

10,000 and INR 21,000 per month.

Calculation of Bonus

Section 12 of the Act has been amended to state

that where the salary or wage of an employee exceeds INR 7,000 per month or the

minimum wage for the scheduled employment, the bonus payable to such employee

shall be calculated as if his salary or wage were INR 7,000 per month or the

minimum wage, whichever is higher.

The

Principal Act provided that the bonus payable to an employee shall be in

proportion to his/her salary. However, where an employee's salary was over INR

3,500 per month, for the purposes of calculating bonus, the salary was to be

assumed to be INR 3,500 per month. To maximise employee bonus earnings, the Amendment

Act has increased the wage ceiling for calculation to INR 7,000 or the minimum

wage payable to such employees may be over INR 7,000, this gives an opportunity

to the employees the flexibility to draw a higher amount as bonus.

Conclusion: Bonus payable to an employee shall be

prorated basis the number of days worked during the respective year, minimum

wages of respective state and 7000 INR which so ever is higher.

0 Comments